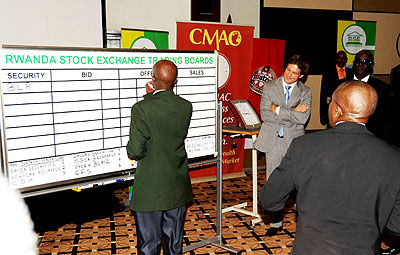

In a bid to facilitate the development of products and services of the country’s capital markets, the Rwanda Stock Exchange has launched the stock exchange share index.

In a bid to facilitate the development of products and services of the country’s capital markets, the Rwanda Stock Exchange has launched the stock exchange share index.According to experts, the index will help in providing a composite report on market performance of constituent stocks so as to highlight the general market trend and that of the entire economy."The index aims at tracking the performances of companies listed on stock exchange,” Dr. James Ndahiro, the chairman of the Rwanda Stock Exchange, said during the launch.Ndahiro says that the index is expected to evolve as an attractive investable index that can be used as a performance benchmark for international investors investing on the RSE as it is built on best standards that put emphasis on transparency, independence, innovation and proper governance."This new initiative confirms Rwanda Stock Exchange’s continued strive to (attract) investors around the globe,” he added.Like Consumer Price Index (CPI) that gauges the level of inflation in the economy, the index acts as a gauge on how the stocks are performing, whether they are rising or falling and reasons behind it. According to Robert Mathu, Executive Director of Capital Markets Authority (CMA), the launch is an opportune time for the growing interest of international investment community for investment opportunities in Africa and Africa’s listed companies.Mathu said the launch of RSE index was a milestone for RSE. He added that the index is seen as an independently calculated; rules based performance benchmark for the country’s equities at the stock exchange. The Governor, National Bank of Rwanda, Claver Gatete, said the index is a standard measure of how the stocks are doing within the stock exchange which makes it easier to be able to compare Rwanda and other countries to determine how the local market is faring."For people who are investing, it gives them an idea of where the market is going,” he said, adding, "that means you know how to evaluate your portfolio and as for the fund managers, they have something else to compare their own stocks with."And this also helps us in terms of raising resources both domestically and internationally so that we can get enough money to invest in our economy,” he notedThe development comes ahead of the country’s fragile stock market that is now wooing small and medium enterprises to be cross-listed, a move geared towards helping the struggling SME sector to raise finances for its growth. Again, the index is built as a barometer for RSE’s performance in general and acts as an additional barometer of the domestically listed companies’ performance with a view that the listed companies are good representatives of their sectors.Nevertheless, the region is hampered by lack of harmonised processes for the stock markets. Once effected, though, it is expected to bring about one electronic system bringing the Rwanda Stock Exchange on equal footing with Kenya and Uganda stock markets. "The processes are the one that need to be harmonised; otherwise, it is not worth to have shares that I cannot trade,” Bob Karina of Kenya’s Faida Investment Bank, said.But The East African Stock Exchanges Association is trying to remove the bottlenecks to bring about smooth trading with harmonised trading of shares at equal prices in the region.