NYARUGENGE - President Paul Kagame has called on the staff of the National Bank of Rwanda to be result-oriented and modernise their operations if the bank is to compete favourably within the East African Community and beyond.Kagame was speaking to Central Bank staff during his impromptu visit to the bank’s premises yesterday morning.President Kagame urged the employees of the bank to always evaluate their performance and be accountable when executing their duties to produce tangible results. Speaking to the over 450 workers taken by surprise by his visit, Kagame said that it’s necessary for government employees to do a ‘balancing act’ before they could demand for salary increments.He was responding to queries raised by the bank’s employees about the salary structure which does not consider the amount of effort an employee puts into work but rather emphasises on experience and time the person has spent working at the bank.

NYARUGENGE - President Paul Kagame has called on the staff of the National Bank of Rwanda to be result-oriented and modernise their operations if the bank is to compete favourably within the East African Community and beyond.

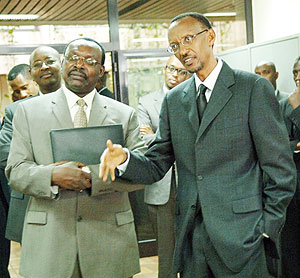

Kagame was speaking to Central Bank staff during his impromptu visit to the bank’s premises yesterday morning.

President Kagame urged the employees of the bank to always evaluate their performance and be accountable when executing their duties to produce tangible results.

Speaking to the over 450 workers taken by surprise by his visit, Kagame said that it’s necessary for government employees to do a ‘balancing act’ before they could demand for salary increments.

He was responding to queries raised by the bank’s employees about the salary structure which does not consider the amount of effort an employee puts into work but rather emphasises on experience and time the person has spent working at the bank.

In his response, Kagame assured the Central Bank employees that he would follow up the issue of salary structures with management but warned that what should be put into consideration is evaluating the work done before coming up with a system that fits all.

He observed that years of experience should not be a yardstick for considering the salary but rather the results available, adding that even him, come 2010 if he has to stand, Rwandans will not be looking at the experience of 7 years in power but rather what he achieved within his time.

He reminded the employees that they work for an institution that is a bedrock for the country’s economy and which the nation looks upon while pursuing its development agenda.

Stressing the issue of modernisation, Kagame said the bank needs to adopt this norm if it is to ‘move with time’ by embracing ICT tools.

He urged the employees to take English lessons to compliment French especially at this time when the country is integrated into the EAC. He also emphasised the need for good customer care practices reminding the staff that giving clients good service is key in maintaining the bank’s image.

Following complaints by employees that the Central Bank does not facilitate further training, Kagame advised the management to build workers capacity to higher levels possible, adding that mediocrity should not be given room by denying workers further training and skills.

He also urged the Bank to adopt a more appropriate corporate dress code suiting the institution’s image and importance, an idea which was met with deafening applause.

Central Bank Governor Francois Kanimba said that despite major setbacks caused by the global meltdown, the bank has continued to focus on major objectives of ensuring and monitoring a stable and solid monetary situation.

"Central Bank has tried much to fulfil its objectives despite many challenges. We have maintained stability in the banking sector, we put in place a sound security system threat will drive our banking industry to greater heights,” Kanimba said.

Kanimba noted that the biggest challenge facing the bank is that it (bank) spends over US $10 million annually to issue new notes because people have refused to embrace electronic banking and prefer direct cash transactions, leading to quick deterioration of notes.

He also said a lot has been registered in the past including establishing a capital markets authority, curbing inflation despite exogenous shocks and monitoring a steady growth of Rwanda’s banking sector.

Ends